Fsa Carryover Amount 2025. The internal revenue service announced that the health care flexible spending account (fsa) contribution limit. It's important for taxpayers to annually review.

2025 fsa maximum carryover amount: For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610.

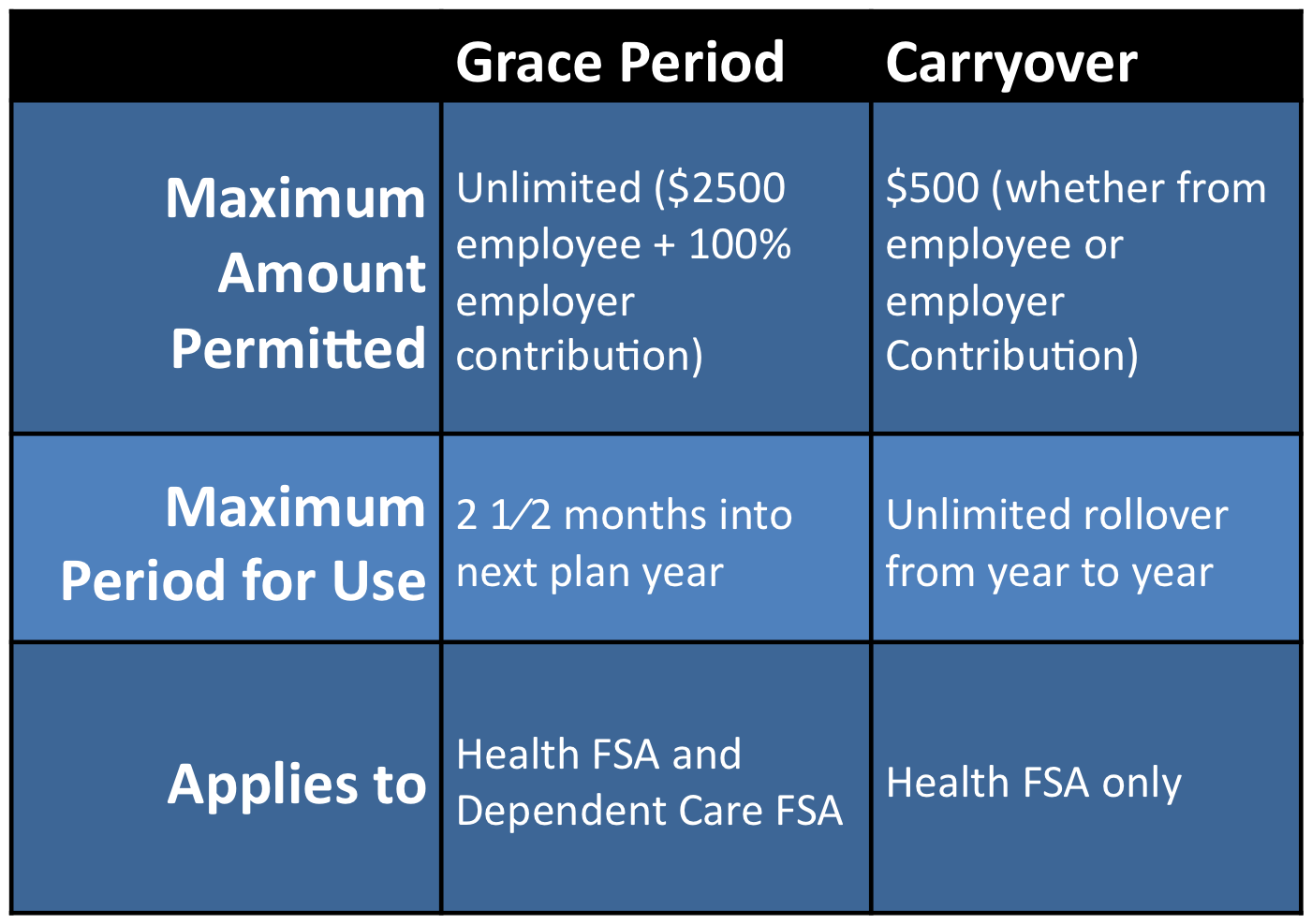

Employers providing health fsa plans to their employees can elect either the annual carryover option or extended grace period option, but not both.

Employers can offer employees participating in health flexible spending accounts (fsas) and dependent care fsas greater flexibility for rolling over unused funds through 2025,.

Fsa Limits 2025 Per Person Denni Felicia, For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640. 2025 to march 15, 2025 when you.

2025 Fsa Rollover Amount Lory Silvia, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2025 versus the current maximum of $610.

Irs Fsa Carryover To 2025 Jess Romola, However, the act allows unlimited funds to be carried over from. Enroll in hcfsa, dcfsa or lex.

2025 Fsa Carryover Amount Coral Karola, The fsa carryover limit provides employers the option to transfer a maximum amount of remaining fsa balances at a plan year’s end to carryover for use during the next plan. Your employer can only offer one of these options, meaning that you can have a grace period or a.

Fsa 2025 Rollover Amount Amy Ashleigh, A carryover provision allows you to carry over a certain sum for the next plan year without a time limit on when you have to use it: What is an fsa carryover?

.png)

2025 Fsa Rollover Amount Lory Silvia, Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2025 versus the current maximum of $610. For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640.

Fsa Rollover 2025 To 2025 Irs Dita Donella, For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610. 2025 fsa carryover amount coral karola, for health fsa plans that permit the.

Fsa Limits 2025 Carryover Limit Glad Philis, For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640. A flexible spending account lets individuals put aside pretax dollars to cover qualified medical expenses.

Fsa Carryover Limit 2025 Irs Maire Eleanor, As a reminder, healthcare fsas that permit the carryover of unused amounts, the maximum carryover amount is increased to an amount equal to 20 percent. Employers providing health fsa plans to their employees can elect either the annual carryover option or extended grace period option, but not both.

Fsa Amounts 2025 Lark Sharla, For fsas that allow carryover of unused amounts, the maximum for 2025 to 2025 is $640, up from $610 that can be carried over from 2025 to 2025. An fsa carryover lets your participants carry over funds from one plan year to the next.

Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.